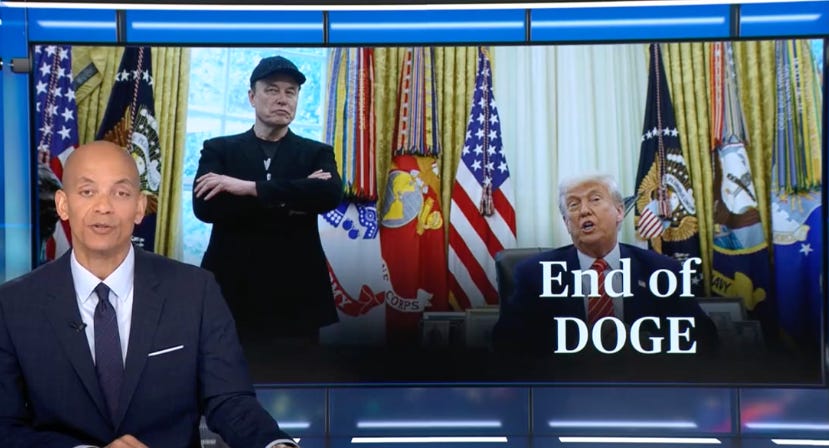

Maximal Disruption, Minimal Results

Why Elon Musk’s Washington experiment collapsed, Tesla’s sales are sagging, and hype can’t replace competence

One of the great lies sold by Elon Musk and eagerly embraced by Donald Trump is that government works like a stock: bloated, inefficient, overvalued, and ripe for a hostile takeover by a swaggering outsider who “knows business.” Slash first, brag loudly, call the wreckage “efficiency,” and move on before anyone audits the results. It’s pump-and-dump economics dressed up as patriotism.

DOGE was the purest expression of that lie. Musk arrived in Washington convinced that federal agencies were just poorly run startups waiting for a genius with a spreadsheet and an attitude problem. What he discovered instead, and still refuses to acknowledge, is that government doesn’t exist to generate hype, juice valuations, or reward early believers. It exists to do things that are boring, complex, legally constrained, and profoundly human. You can’t inflate your way out of that reality. You can only break it.

And break it they did. DOGE promised to cut $2 trillion from federal spending. Then it quietly walked that back to $1 trillion. By spring, the brag had collapsed to $150 billion. By year’s end, DOGE’s own “Wall of Receipts” claimed about $214 billion in savings, roughly 3 percent of a $7 trillion federal budget, and even that figure collapsed under scrutiny.

When reporters examined DOGE’s biggest claims, the results were almost comical. Twenty-eight of the top forty savings claims were wrong. The thirteen largest were all incorrect. Two Defense Department contracts DOGE said saved $7.9 billion were never canceled at all. Several “cuts” had already ended under the previous administration. Others were simply allowed to expire on schedule. In multiple cases, DOGE claimed savings by lowering the maximum possible value of contracts, the ceiling, without reducing actual spending by a single dollar. It was accounting theater, not budget reform.

Independent analysis found that while DOGE terminated tens of thousands of contracts and grants, the actual amount of money the government pulled back was only a few billion dollars more than in prior years, statistical noise at the federal scale. Meanwhile, a Senate investigation estimated DOGE generated at least $21.7 billion in waste, largely by paying people not to work, buying out contracts prematurely, and triggering litigation that reversed many of its own actions.

Most damning of all, DOGE never engaged with the parts of the federal budget that actually require long-term, serious policy work. It did not address interest on the debt, now one of the fastest-growing federal expenditures. It did not meaningfully engage with health-care cost growth, particularly within Medicare and Medicaid, where spending pressures are driven by prices, demographics, and private-sector dynamics, not bureaucratic “waste.” And it certainly did not touch military spending, which in fact increased.

Instead, DOGE focused almost entirely on the easiest targets: discretionary programs with relatively small dollar figures, many of which are funded annually and lack strong political defenses. The result was spectacle without substance. Overall federal outlays were higher in 2025 than in 2024, and the deficit remained essentially unchanged, proof that DOGE’s approach never grappled with the structure of federal spending at all.

What DOGE did do was tear through thousands of small programs whose dollar amounts were insignificant to Washington but life-altering to the people who depended on them. Aid groups lost funding overnight. Museums and libraries shuttered programs that were later reinstated by courts. Refugee services were cut mid-crisis. Research grants were killed after data had already been collected, rendering years of work useless. Eighty percent of DOGE’s claimed “savings” came from cancellations of $1 million or less, small enough to be meaningless to the budget, large enough to devastate communities.

That’s how DOGE managed the impossible feat of maximal disruption with minimal savings. It inflated results by double-counting cancellations, claiming credit for actions it didn’t take, and leaving reversed or reinstated programs on its scoreboard as if nothing had happened. Then, when the numbers refused to improve and the courts kept intervening, DOGE simply… evaporated. Months before its planned end date, officials couldn’t even agree on whether it still existed. A classic Musk move: when the numbers turn ugly, change the subject, or disappear.

But DOGE wasn’t just a fiscal failure, it was an ideological dress rehearsal. That same mentality, institutions are fake, rules are optional, expertise is elitism, is now being aimed squarely at one of the least flashy, most effective agencies in the federal government: the Consumer Financial Protection Bureau.

The CFPB is the anti-Tesla, because it doesn’t sell dreams, or promise moonshots. It doesn’t pump a stock price. It answers complaints, and builds paper trails, forces billion-dollar companies to explain themselves, corrects credit reports, stops illegal fees, and returns money to people who were cheated. Since its creation, it has sent more than $21 billion back to consumers, quietly, methodically, and all on a tiny budget and without a cult following or a merch store.

Which is exactly why Trump and Musk-aligned ideologues hate it. From their perspective, the CFPB commits the unforgivable sin of working. It proves that government can be competent, targeted, and effective when it has a clear mandate and independence from political donors. It stands directly in the way of the pump-and-dump model by insisting that the numbers correspond to reality, that debt must be real, fees must be legal, contracts must be honored, and people must have recourse when powerful actors cheat.

That’s intolerable in a worldview where markets are supposed to be performative and regulation is just friction to be eliminated. So now the CFPB is being slowly strangled: funding capped, staff purged, enforcement paused, investigations dumped, rules rolled back. The administration openly says it wants the agency gone. The budget director is trying to starve it until it collapses. And the justification is always the same tired con: redundancy, overreach, freedom, efficiency. The same words Musk used while lighting DOGE on fire.

What makes this especially grim, and revealing, is who gets hurt. It’s not the hedge funds, nor private equity. Certainly not Elon Musk, who can sell tens of billions in stock while insisting wealth only comes from “useful products.” It’s people like a special education teacher whose student debt was double-counted until the CFPB forced a credit bureau to fix it. A single mother navigating identity theft. A transplant patient using CFPB databases to stop illegal debt collection. People who don’t need hype. They need a cop on the beat.

And here’s where the uninvited but thoroughly deserved schadenfreude creeps in. At the very moment Musk’s ideology is collapsing in government, exposed as reckless, destructive, and unserious, it’s also unraveling in his own backyard. Tesla sales are slipping. Deliveries are down. Competition is eating away at the fantasy that Tesla is synonymous with the future. The Cybertruck is a colossal failure and has become an expensive meme. Suddenly the man who once let the stock “speak for itself” is furiously tweeting defenses of why the stock is definitely not disconnected from reality. When the hype man starts explaining, the spell is breaking.

Tesla is being treated increasingly, like what it actually is: a car company in a brutally competitive market, selling products next to gelato and ski masks, not relics in a temple. And DOGE has already been treated like what it was: a flashy stunt that couldn’t survive contact with facts, courts, or accountability.

The CFPB fight shows us what happens next if that ideology is allowed to keep marching. The conmen don’t stop at breaking things that look abstract. They move on to dismantling the quiet systems that keep ordinary people from being crushed by financial predators,essentially like Musk himself.

And that, ultimately, is the story of 2025: the collision between hype economics and reality, and the growing evidence that reality, however bruised, is starting to push back.

Taking the win…at this point small wins always hope for more

A federal judge on Tuesday ruled that funding for the Consumer Financial Protection Bureau cannot lapse, a blow to the Trump administration, which had declared the agency’s cash stream illegal.

https://www.nytimes.com/2025/12/30/business/consumer-financial-protection-bureau-funding-trump-vought.html

Thank you for keeping me informed on what's going on in this chaotic administration. I love all your snarky comments!